Apr.26, 2024

Komatsu Ltd. today announced its consolidated business results for the fiscal year ended March 31, 2024 (U.S. GAAP). The highlights are described below.

In the following, "the Company" expresses Komatsu Ltd. on a non-consolidated basis, while "Komatsu", on a consolidated basis.

1. Results for the Fiscal Year Ended March 31, 2024(FY2023)

For the fiscal year under review (April 1, 2023 - March 31, 2024), the second year of the mid-term management plan, consolidated net sales totaled JPY 3,865.1 billion, an increase of 9.1% from the previous fiscal year. In the construction, mining and utility equipment business, demand for construction equipment decreased mainly in Latin America, Europe and Asia, but remained steady in North America. Demand for mining equipment remained strong against the backdrop of sustained stability in resource prices. Sales increased from the previous fiscal year, supported in part by expanded parts sales and service revenues, reflecting high machine utilization rates, especially for mining equipment, improved selling prices in most regions of the world, and the depreciation of the Japanese yen. In the industrial machinery and others business, sales increased from the previous fiscal year, mainly due to increased sales of large presses for the automobile manufacturing industry.

In terms of profits, operating income for the fiscal year under review increased by 23.7% from the previous fiscal year, to JPY 607.2 billion. This was due to improved selling prices in most regions of the world, and the Japanese yen’s depreciation, which more than offset the adverse effects of increased fixed costs and material prices. The operating income ratio increased by 1.9 percentage points to 15.7%. Income before income taxes and equity in earnings of affiliated companies increased by 20.8% to JPY 575.7 billion. Net income attributable to Komatsu Ltd. increased by 20.5% to JPY 393.4 billion.

2. Projections for the Fiscal Year Ending March 31, 2025(FY2024)

In the construction, mining and utility equipment business, Komatsu expects demand for mining equipment will begin to slow down in Indonesia but remain flat from the fiscal year under review in other regions. Komatsu also anticipates that demand for construction equipment will decline, because interest rates and energy prices are projected to remain high. In addition, Komatsu projects that the Japanese yen will appreciate. As a result, sales will decrease from the fiscal year under review. With respect to segment profit, although Komatsu will continue to improve selling prices, it anticipates a decrease, mainly affected by reduced volume of sales, the appreciation of the Japanese yen, and increased fixed costs.

In the retail finance business, Komatsu expects an increase in revenues, as affected by rising interest rates, but a decline in segment profit, mainly due to reduced resale profits of used equipment after leasing use.

In the industrial machinery and others business, Komatsu anticipates that both sales and segment profit will increase from the fiscal year under review, due to expected recovery of maintenance revenues of the excimer laser-related business for the semiconductor industry.

As a result, Komatsu projects a decrease in both consolidated sales and profits for the fiscal year ending March 31, 2025.

Komatsu is now considering reassessing the investment relationship within the Komatsu Group, such as bringing Latin American subsidiaries managed by a North American subsidiary under direct control of the Company. Even if such a change of investment relationship is carried out, the impact of this matter on consolidated business results for the fiscal year ending March 31, 2025 will be minimal.

As preconditions for its projection, Komatsu is assuming the foreign exchange rates will be as follows:

USD1=JPY 140.0, EUR1=JPY 149.0, and AUD1=JPY 90.0.

3. Cash Dividends

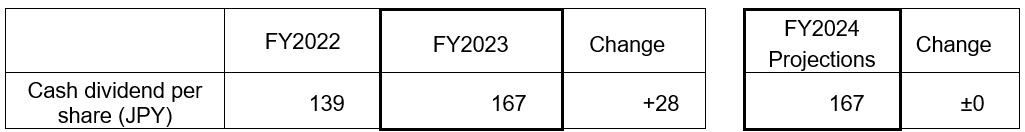

Concerning cash dividends for the fiscal year under review, after considering consolidated business results for the fiscal year under review and future business prospects, the Company is planning to increase the year-end common stock dividend per share by JPY 23 from the earlier projection of JPY 72 per share. As a result, the year-end cash dividend for the fiscal year under review should amount to JPY 95 per share. Annual cash dividends should total JPY 167 per share, including the interim cash dividend which has already been paid, and which shows an increase of JPY 28 per share from the previous fiscal year, ended March 31, 2023. Accordingly, the consolidated payout ratio will translate into 40.1%. This dividend amount will be proposed to the 155th ordinary general meeting of shareholders (scheduled for June 19, 2024).

Regarding the fiscal year, ending March 31, 2025, while net income is projected to decrease, the Company plans to pay JPY 167 per share for annual cash dividends, keeping the same amount from the fiscal year under review. The consolidated payout ratio should be translated into 45.5%.