Oct. 31, 2022

Komatsu Ltd. (“Company”) (President and CEO: Hiroyuki Ogawa) and its consolidated subsidiaries (together “Komatsu”) have revised the projections for consolidated business results as well as cash dividend for the fiscal year ending March 31, 2023 (April 1, 2022 - March 31, 2023), which Komatsu announced on April 28, 2022.

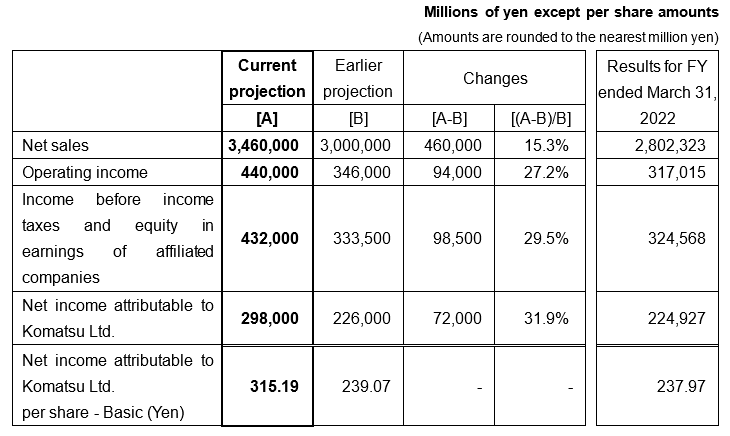

1.Projection for Consolidated Business Results for the Fiscal Year Ending March 31, 2023 (U.S. GAAP)

Reasons for the Revision

In the construction, mining and utility equipment business, Komatsu projects demand will remain strong in North America and Asia. While there are concerns about an economic slowdown due to rising interest rates, supply shortages caused by disruptions in the supply chain are expected to improve. Komatsu projects business results to outperform its initial projection, as Komatsu has been making good progress in the improvement of selling prices.

Concerning foreign exchange rates, which are preconditions for the projection of full-year results, Komatsu has revised the projected exchange rates (to USD 1=JPY 140, EUR 1=JPY 137 and AUD 1=JPY 89 as the average exchange rate in the second six-month period), in response to the Japanese yen’s more-than-anticipated depreciation. As a result, Komatsu is revising projected consolidated sales and profits for the year, which it announced on April 28, 2022.

Komatsu estimates the average exchange rates for the full year as follows: USD 1=JPY 135.8, EUR 1=JPY 137.5 and AUD 1=JPY 91.0 (Initial assumption: USD 1=JPY 118.0, EUR 1=JPY 129.0 and AUD 1=JPY 88.0)

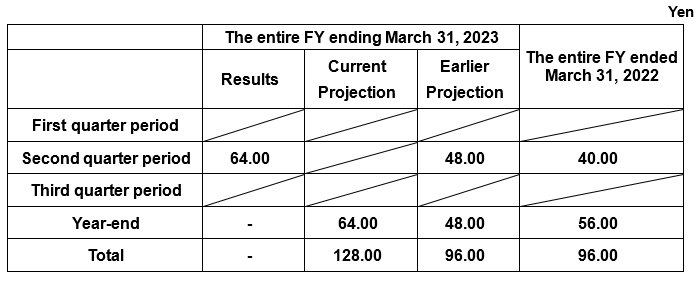

2.Revision of Projected Cash Dividend

Reasons for the Revision

Komatsu is building a sound financial position and is enhancing its competitiveness in order to increase its sustainable corporate value. Concerning cash dividends, Komatsu has the policy of continuing stable payment of dividends after comprehensively considering consolidated business results and reviewing future investment plans, cash flows and the like. Specifically, Komatsu has the policy of maintaining a consolidated payout ratio of 40% or higher.

Concerning the interim cash dividend under this basic policy, after reviewing business results for the first six-month period under review and considering future business prospects, Komatsu is planning to increase JPY 16 per share from the projection of April 28 this year, to JPY 64 per share. Similarly, with respect to the year-end cash dividend, Komatsu is also planning to increase that dividend by JPY 16 from the projection, to JPY 64 per share. As a result, Komatsu plans to pay annual cash dividends of JPY 128 per share, increase of JPY 32 per share from the previous fiscal year ended March 31, 2022. The consolidated payout ratio will become 40.6%.

Cautionary Statement

The announcement set forth herein contains forward-looking statements which reflect management's current views with respect to certain future events, including expected financial position, operating results, and business strategies. These statements can be identified by the use of terms such as "will,"“believes,” "should," "projects" and similar terms and expressions that identify future events or expectations. Actual results may differ materially from those projected, and the events and results of such forward-looking assumptions cannot be assured.

Factors that may cause actual results to differ materially from those predicted by such forward-looking statements include, but are not limited to, unanticipated changes in demand for the Company's principal products, owing to changes in the economic conditions in the Company’s principal markets; changes in exchange rates or the impact of increased competition; unanticipated cost or delays encountered in achieving the Company's objectives with respect to globalized product sourcing and new Information Technology tools; uncertainties as to the results of the Company's research and development efforts and its ability to access and protect certain intellectual property rights; and, the impact of regulatory changes and accounting principles and practices.

No : 0060(3180)

Corporate Communications Department

Sustainability Promotion Division

Komatsu Ltd.

tel: +81-(0)3-5561-2616

mail: JP00MB_cc_department@global.komatsu

*The information may be subject to change without notice.