Apr.28,2022

Komatsu Ltd. today announced its consolidated business results for the fiscal year ended March 31, 2022 (U.S. GAAP). The highlights are described below.

In the following, “the Company” expresses Komatsu Ltd. on a non-consolidated basis, while “Komatsu”, on a consolidated basis.

1. Results for the Fiscal Year Ended March 31, 2022(FY2021)

For the fiscal year under review (April 1, 2021 ? March 31, 2022), the final year of the mid-term management plan, consolidated net sales totaled JPY 2,802.3 billion, up 28.0% from the previous fiscal year. In the construction, mining and utility equipment business, demand for both construction and mining equipment was strong around the world, except for China, as the adverse effects of the coronavirus (COVID-19) pandemic shrank from the previous fiscal year. Komatsu steadily captured expanding demand for new equipment by capitalizing particularly on cross-sourcing, while experiencing the adverse effects of the tight market of marine transportation and semiconductor shortage. Reflecting increased parts sales and service revenues as well, sales expanded sharply from the previous fiscal year. In the industrial machinery and others business, with respect to the businesses of presses, sheet-metal machines, and machine tools, Komatsu improved sales from the previous fiscal year, by completing installation of machinery at overseas customers’ plants, as the governments of related countries eased their regulations on economic activities. Moreover, sales of the Excimer laser-related business advanced, supported by an increase in global demand for semiconductors. As a result, sales increased from the previous fiscal year.

With respect to profits for the fiscal year under review, operating income surged by 89.5% from the previous fiscal year, to JPY 317.0 billion. This was mainly due to expanded sales volume and improved selling prices in many regions in the construction, mining and utility equipment business, as well as the Japanese yen's depreciation, which more than offset the adverse effects of increased prices of materials and logistical costs. The operating income ratio improved by 3.7 percentage points to 11.3%. Income before income taxes and equity in earnings of affiliated companies expanded sharply by 99.4% to JPY 324.5 billion. Net income attributable to Komatsu Ltd. climbed to JPY 224.9 billion, up 111.7%.

2. Projections for the Fiscal Year Ending March 31, 2023(FY2022)

Concerning the consolidated business results for the fiscal year ending March 31, 2023, Komatsu projects an increase in both sales and profits.

In the construction, mining and utility equipment business, Komatsu anticipates an increase in sales against the background of strong demand around the world, centering on North America and Asia, as well as the Japanese yen’s depreciation. Demand in CIS and China is estimated to decline. With respect to segment profit, Komatsu also anticipates an increase, supported by the expected expansion of sales volume, improvement of selling prices, and the Japanese yen’s depreciation, which will absorb the anticipated increase in prices of materials and logistics costs. As of today, it is impossible to predict any impacts, including supply chain confusion, in Russia due to the situation in Ukraine. Therefore, this projection is based on the assumption that Komatsu will sell products that are in local stock or already shipped there as of March 31, 2022.

In the retail finance business, Komatsu anticipates a decrease in both sales and segment profit, mainly due to declined sales of used equipment after lease use and no more benefits of improved valuation of equipment after lease use, which were recorded in the previous fiscal year.

In the industrial machinery and others business, while the Excimer laser-related business for the semiconductor market is expected to increase sales, Komatsu projects a decline in both sales and segment profit due mainly to reduced sales of medium-sized and large presses to the automobile manufacturing industry.

As preconditions for its projection, Komatsu is assuming the foreign exchange rates will be as follows: USD1=JPY 118.0, EUR1=JPY 129.0, and AUD1=JPY 88.0.

3. Cash Dividends

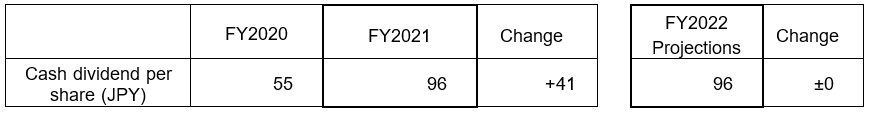

Concerning cash dividends for the fiscal year under review, after considering consolidated business results for the fiscal year under review and future business prospects, the Company is planning to increase the year-end common stock dividend per share by JPY 16 from the earlier projection of JPY 40 per share. As a result, year-end cash dividend for the fiscal year under review should amount to JPY 56 per share. Annual cash dividends should total JPY 96 per share, including the interim cash dividend which has already been paid, and which shows an increase of JPY 41 per share from the previous fiscal year, ended March 31, 2021. Accordingly, the consolidated payout ratio will translate into 40.3%. This dividend amount will be proposed to the 153rd ordinary general meeting of shareholders (scheduled for June 21, 2022).

Regarding annual cash dividends for the fiscal year, ending March 31, 2023, the Company plans to pay JPY 96 per share, keeping the same amount from the fiscal year under review.

No : 0007(3127)

Corporate Communications Department

Sustainability Promotion Division

Komatsu Ltd.

tel: +81-(0)3-5561-2616

mail: JP00MB_cc_department@global.komatsu

*The information may be subject to change without notice.