Apr. 30, 2021

Komatsu Ltd. (President and CEO: Hiroyuki Ogawa) (hereafter “the Company”) informs that there is the difference between projected consolidated business results of October 28, 2020 for the fiscal year ended March 31, 2021 (April 1, 2020 – March 31, 2021) and actual results which were disclosed today.

The Company does not disclose projections of non-consolidated business results. However, please be informed of the difference between non-consolidated business results for the fiscal year ended March 31, 2021 and those for the previous fiscal year.

Please be also informed that the Board of Directors, in its meeting on April 30, 2021, resolved to propose at the 152th ordinary general shareholders’ meeting that the Company will change the latest projection of retained earnings with the record date of March 31, 2021 and pay dividends.

Specifics

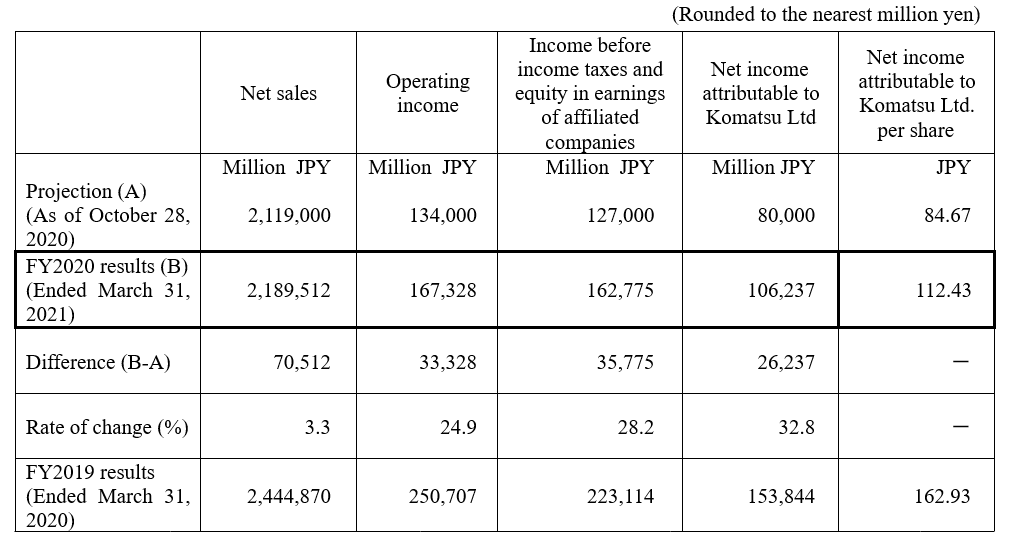

1.Difference between projected consolidated business results for the fiscal year ended March 31, 2021 and actual results (April 1, 2020 to March 31, 2021)

[Reasons for the difference]

While consolidated sales and profits declined from the previous fiscal year for the fiscal year under review, as adversely affected by the coronavirus (COVID-19) pandemic, demand recovered, centering on construction equipment, sooner than expected, starting in the third quarter. As a result, both sales and profits for the year outperformed the earlier projection.

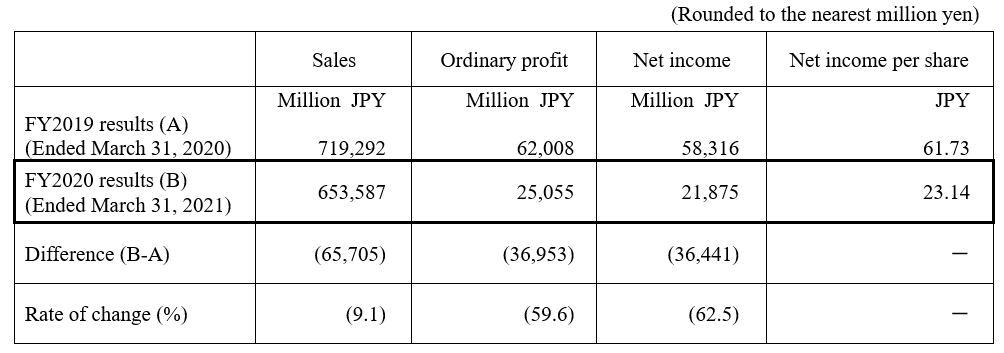

2.Difference between non-consolidated results for the fiscal year ended March 31, 2021 and those for the previous fiscal year (April 1, 2020 to March 31, 2021)

[Reasons for the difference]

Concerning non-consolidated business results, demand for construction and mining equipment remained sluggish, as adversely affected by the coronavirus (COVID-19) pandemic, which reduced the Company’s sales. The Company also recorded extraordinary loss resulting from the revision of its retirement benefit program. As a result, both sales and profits declined for the fiscal year under review.

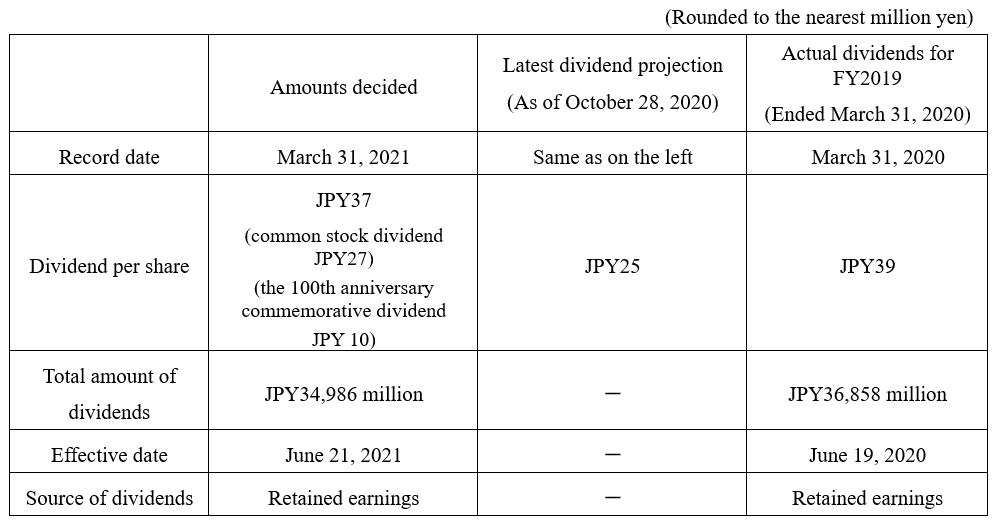

3.Details of dividend

[Reason for the change of projected cash dividend]

Komatsu is building a sound financial position and enhancing its competitiveness in order to increase its sustainable corporate value. Concerning cash dividends, Komatsu has the policy of continuing stable payment of dividends after comprehensively considering consolidated business results and reviewing future investment plans, cash flows and the like. Specifically, Komatsu has the policy of maintaining a consolidated payout ratio of 40% or higher.

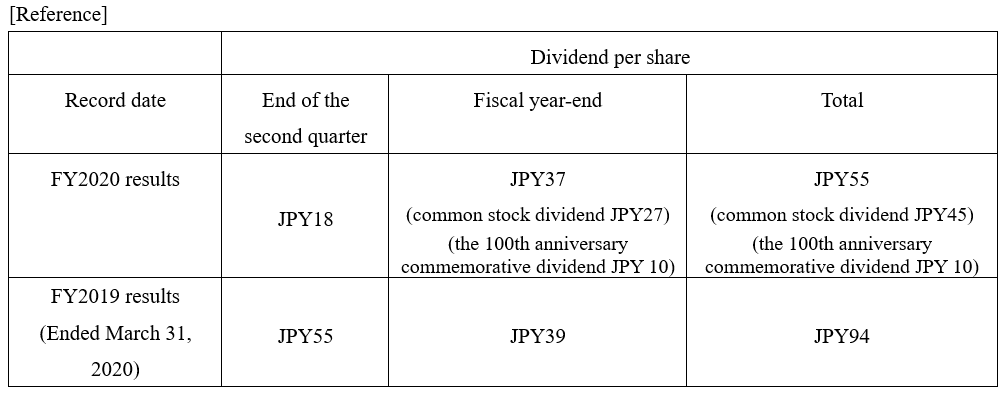

Concerning cash dividends for the fiscal year under review, after considering consolidated business results for the fiscal year under review and future business prospects under its dividend policy, the Company is planning to pay JPY 27 per share for year-end dividends by adding a common stock dividend of JPY 2 per share to the earlier projection of JPY 25 per share. Furthermore, the Company is going to celebrate its 100th anniversary on May 13, this year. To express appreciation to shareholders for their support over the years, the Company plans to pay the 100th anniversary commemorative cash dividend of JPY 10 per share. As a result, year-end cash dividends for the fiscal year under review should amount to JPY 37 per share, i.e., JPY 12 more than the latest projection of cash dividends. Annual cash dividends should total JPY 55 per share, including the interim cash dividend which has already been paid. Accordingly, the consolidated payout ratio will translate into 48.9%. This dividend amount will be proposed to the 152nd ordinary general meeting of shareholders (scheduled for June 18, 2021).

No : 0010(3026)

Corporate Communications Department

Sustainability Promotion Division

Komatsu Ltd.

tel: +81-(0)3-5561-2616

mail: JP00mb_cc_department@global.komatsu

*The information described is at the time of presentation and may be subject to advance notice.