Apr. 30, 2021

Komatsu Ltd. today announced its consolidated business results for the fiscal year ended March 31, 2021 (U.S. GAAP). The highlights are described below.

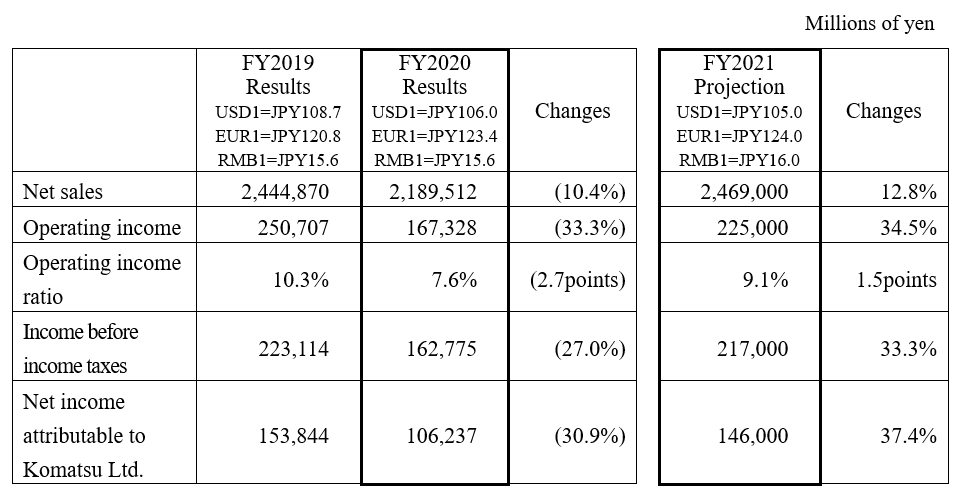

1. Results for the Fiscal Year Ended March 31, 2021(FY2020)

For the fiscal year under review (April 1, 2020 - March 31, 2021), the second year of the mid-term management plan, consolidated net sales totaled JPY 2,189.5 billion, down 10.4% from the previous fiscal year. Under unclear and uncertain conditions as affected by the coronavirus (COVID-19) pandemic, in the construction, mining and utility equipment business, demand showed steady recovery, centering on construction equipment, in the second six-month period. However, sales decreased from the previous fiscal year, as full-year demand was critically affected by the coronavirus (COVID-19) pandemic in the first six-month period. In the industrial machinery and others business, sales fell from the previous fiscal year, as affected by sluggish capital investment of the automobile manufacturing industry for presses, sheet-metal machines, and machine tools.

With respect to profits for the fiscal year under review, operating income dropped by 33.3% from the previous fiscal year, to JPY 167.3 billion. This was mainly due to reduced sales volume, and changes in the compositions of sales, in the construction, mining and utility equipment business, as well as the Japanese yen's appreciation, even while Komatsu worked to reduce fixed costs. The operating income ratio decreased by 2.7 percentage points to 7.6%. Income before income taxes and equity in earnings of affiliated companies fell by 27.0% to JPY 162.7 billion. Net income attributable to Komatsu Ltd. totaled JPY 106.2 billion, down 30.9%.

2. Projections for the Fiscal Year Ending March 31, 2022 (FY2021)

In the construction, mining and utility equipment business, Komatsu projects that both sales and profits will increase, as it believes that demand will continue to recover from the fiscal year under review, returning to the level prior to the coronavirus (COVID-19) pandemic. By region, Komatsu anticipates demand will expand, especially in Asia, North America and Latin America. In China, Komatsu expects that demand will decline from the fiscal year under review, when the post-Chinese New Year sales season occurred twice. Nevertheless, Komatsu projects that global demand will increase from the fiscal year under review. Furthermore, Komatsu projects that demand for mining equipment will remain steady in iron ore, copper, and gold mines, while it will enter a recovery track in coal mines. With respect to profits, Komatsu expects that they will advance, reflecting an increase in volume of sales, differences in composition of sales, and improved selling prices.

In the retail finance business, Komatsu anticipates both sales and segment profit will improve, mainly due to an increase in new contracts. In the industrial machinery and others business, Komatsu projects that both sales and profits will increase, as sales of machine tools and the Excimer laser-related business should grow, respectively, in the automobile manufacturing industry and on the semiconductor market.

As preconditions for its projection, Komatsu is assuming the foreign exchange rates will be as follows: USD1=JPY 105.0, EUR1=JPY 124.0, and RMB1=JPY 16.0.

Notes: Markets as Positioned by Komatsu

Traditional Markets: Japan, North America and Europe

Strategic Markets: China, Latin America, Asia, Oceania, Africa, Middle East and CIS

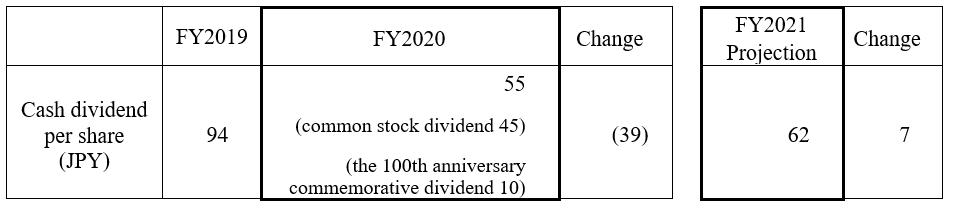

3. Cash Dividends

Concerning cash dividends for the fiscal year under review, after considering consolidated business results for the fiscal year under review and future business prospects, Komatsu Ltd. is planning to increase the year-end common stock dividend per share by JPY 2 from the earlier projection of JPY 25 per share. At the same time, Komatsu Ltd. plans to pay the 100th anniversary (May 13, 2021) commemorative cash dividend of JPY 10 per share. As a result, year-end cash dividends for the fiscal year under review should amount to JPY 37 per share, i.e., JPY 12 more than the latest projection of cash dividends. Annual cash dividends should total JPY 55 per share, including the interim cash dividend which has already been paid, and which is showing a decrease of JPY 39 per share from the previous fiscal year, ended March 31, 2020. Accordingly, the consolidated payout ratio will translate into 48.9%. This dividend amount will be proposed to the 152nd ordinary general meeting of shareholders (scheduled for June 18, 2021).

Regarding annual cash dividends for the fiscal year, ending March 31, 2022, Komatsu Ltd. plans to pay JPY 62 per share, an increase of JPY 7 per share from the fiscal year under review

.

.

No : 0009(3025)

Corporate Communications Department

Sustainability Promotion Division

Komatsu Ltd.

tel: +81-(0)3-5561-2616

mail: JP00mb_cc_department@global.komatsu

*The information described is at the time of presentation and may be subject to advance notice.